👉Introduction

Is Physical Therapy Covered by Insurance? It is the most common question that confuses physical therapists and patients. Understanding the complexities of physical therapy insurance can be challenging, whether patients need insurance for chronic conditions or simply maintaining overall physical health.

“Most insurance plans cover physical therapy as they are considered an essential medical necessity under the Affordable Care Act (ACA).”

ACA covers rehabilitative services, which include physical therapy, speech-language pathology, occupational therapy, and many more.

So, to get paid by an insurance provider, you need insurance plans and follow rules for patients who used services, sessions, and every minor documentation for your services. After proper documentation, you need approval from the insurance provider.

Physical therapists and practices get tangled in this complex web of insurance providers. To eliminate all these insurance nuances, outsource “Physical Therapy Billings,” which takes all physical therapy insurance coverage worries.

Contact us to Get Insurance Coverage Plans.

👉Does Insurance Cover in Every Case of Physical Therapy Billing?

Normally, you can find coverage for physical therapy practices with certain limitations and requirements. See different cases to understand insurance coverage.

**Scenarios Where Insurance Likely Covers Physical Therapy**

Post-Surgical Rehabilitation

Following a knee replacement surgery, physical therapy is often considered medically necessary to regain mobility and strength. Insurance will likely cover these visits as they directly address the surgical outcome.

Pain Management

Chronic back pain caused by a herniated disc can significantly impact daily routine. A physical therapist can design a treatment plan to manage pain and improve function. Here, insurance coverage is likely as physical therapy is a non-invasive approach to pain management.

Injury Recovery

Physical therapy plays a crucial role in recovering from a sports injury like a torn rotator cuff. Insurance will likely cover these sessions since the goal is to restore function and prevent further complications.

CASE1

In-Network Physical Therapy with Met Deductible

- You have a $2,000 deductible and a $20 copay for physical therapy.

- You’ve already met your deductible due to other medical expenses.

- For suppose, each physical therapy session costs $100.

You pay: $20 copay per session.

Insurance pays: The remaining $80 per session (up to the plan limits).

CASE 2

Out-of-Network Physical Therapy with No Precertification

- Your plan requires precertification for out-of-network physical therapy, but you didn’t get it.

- You see an out-of-network physical therapist who charges supposedly $150 per session.

You pay: The total $150 per session

Insurance Pay: (insurance likely won’t cover anything).

CASE 3

Physical Therapy Exceeding Visit Limits

- If your plan allows 20 PT visits per year.

- You exceed the limit due to a complex injury requiring more therapy.

You pay: The total cost of sessions exceeding the limit

Insurance pay: Though some plans might offer exceptions.

CASE 4

Physical Therapy for Maintenance vs. Treatment

- Your plan covers PT for injury treatment but not for general maintenance.

- You need PT to maintain strength after recovering from an injury.

You pay: The complete cost of PT sessions

Insurance pay: Insurance considers its maintenance, not treatment.

CASE 5

Missed PT Appointment

- Your plan charges a fee for missed appointments without notification.

- You must call beforehand before a PT session.

You pay: A cancellation fee on top of any copay or coinsurance

Insurance pay: Check your plan details.

👉When is Physical Therapy Not Covered By Insurance?

**Scenarios Where Insurance Might Not Cover Physical Therapy**

Here are some main scenarios where insurance might not cover physical therapy services.

Chronic Maintenance

After recovering from a knee injury, you might want ongoing physical therapy sessions to maintain strength and stability. While these sessions can be beneficial, insurance may not cover them if they’re deemed maintenance rather than treatment for an ongoing medical condition.

Pain Management for Non-Specific Conditions

Insurance coverage might be limited if you experience chronic neck pain but the cause remains undiagnosed. Here, a doctor’s referral and clear documentation linking physical therapy to pain relief become crucial for coverage approval.

General Wellness Programs

Insurance might not cover if you seek physical therapy to improve overall flexibility or posture without a diagnosed medical condition. This falls under preventive care, and coverage varies depending on your plan.

CASE 1

Self-Referred Physical Therapy without Insurance Coverage

- If patients don’t have health insurance.

- Patients decide to see a physical therapist for pain relief.

You pay: The total cost of physical therapy sessions

Insurance pay: Insurance doesn’t cover because you don’t have it.

CASE 2

Experimental Physical Therapy Techniques

- Your plan excludes coverage for experimental Physical Therapy techniques.

- You want to try a new, non-traditional PT approach.

You pay: The total cost of PT sessions

Insurance pay: Insurance doesn’t cover experimental techniques.

CASE 3

Physical Therapy Services Billed Incorrectly

- The physical therapy billing includes errors or services not covered by your plan.

- You receive a bill for services you didn’t expect or weren’t pre-approved.

You pay: Potentially responsible for the full bill initially,

Insurance pay: You can appeal the charges with your insurance company if they were billed incorrectly.

From these different cases, you will understand for which CASES physical therapy practices get insurance coverage for their patients.

👉Ways to Get Most From Your Insurance Provider

Physical therapists know that managing their patients is quite simple- insurance providers give you a tough time getting reimbursed. Here are some quick ways to get the most from your insurance provider.

Verification

Before starting treatment, verify your insurance coverage for physical therapy with your insurance provider. This includes confirming in-network status, copay/coinsurance amounts, and visit limitations.

Referral

If an insurance plan requires a referral from physical therapy practice, ensure you have clear and loud to get reimbursed.

Documentation

Clear and detailed documentation from the physical therapist is crucial for insurance companies to approve claims.

Partner with a Physical Therapy Billing Service

Consider partnering with a specialized and expert physical therapy billing service to ensure accurate and efficient insurance claim processing.

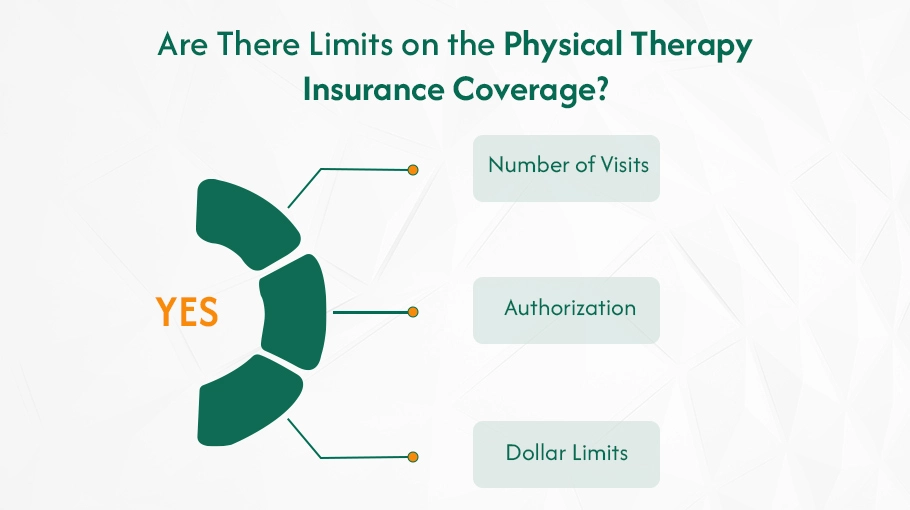

👉Are There Limits on the Physical Therapy Insurance Coverage?

Yes, there’s a limit on insurance plans- that depends upon your plan and insurance provider.

Limits on physical therapy insurance coverage can include:

✔️Number of Visits

Some plans have a yearly or lifetime limit on the number of covered visits.

✔️Authorization

Your insurance may require pre-authorization for extended treatment plans.

✔️Dollar Limits

Specific plans set a maximum dollar amount covered for physical therapy services per year.

👉How do Insurance Providers Work For You?

Insurance companies establish contracts with physical therapy practices. When a patient receives treatment, the practice submits a claim to the insurance provider. The insurance company reviews the claim based on medical necessity, plan details, and pre-authorization requirements.

Key Insurance Providers

Some of the major health insurance companies include:

Does Medicare Cover Physical Therapy Services?

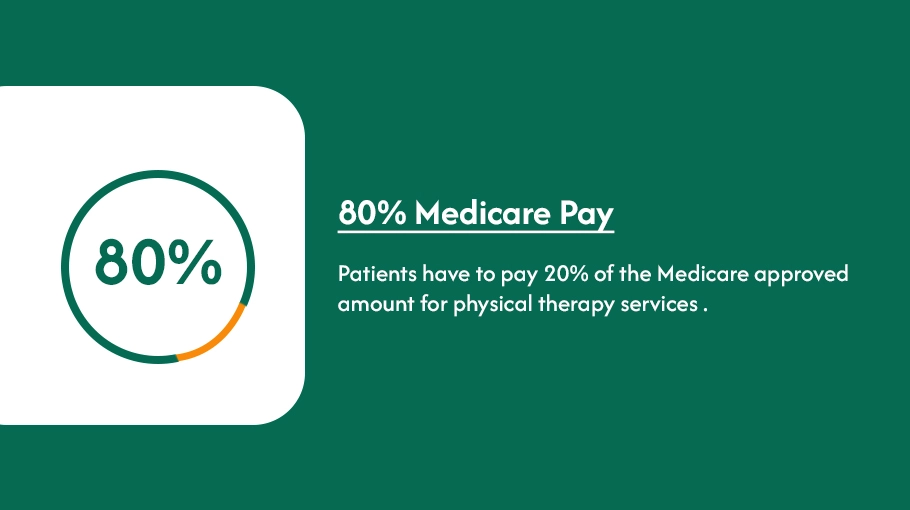

Medicare doesn’t cover complete cost; it pays for both inpatient and outpatient physical therapy services .Medicare pays for physical therapy sessions in different ways:

- Medicare Part A for inpatient physical therapy in the hospital. Part A also pays for physical therapy when a patient is in hospice care.

- Medicare Part B for medical necessity outpatient physical therapy.

A patient meets their Part B deductible Medicare funds for any outpatient physical therapy to get physical therapy insurance coverage.

Once patients get this out-of-pocket cost, they must pay 20% of the Medicare-approved amount for physical therapy services.

Does Medicaid Cover Physical Therapy Services?

Medicaid insurance covers a wide range of medical services, including physical therapy. That means therapists must certify that physical therapy is essential for treating your condition.

Services Covered

- Audiological services

- Occupational Services

- Physical Therapy

- Speech and Language Therapy

Specific Coverage of Medicaid

Your Medicaid coverage for physical therapy is flexible, adapting to your specific needs and circumstances. The exact details will vary depending on your state and customized plan. Here are some resources to help you navigate and understand your insurance coverage better.

Medicaid Plan Provider

Your Medicaid plan provider, such as an HMO or managed care organization, will have specific information about coverage details and any limitations or requirements. You can contact us to learn more about your insurance plan provider.

Medicaid.gov

The official website of Medicaid, Medicaid.gov, is a comprehensive resource that offers detailed information, including a state-by-state directory. This wealth of information is readily available to support you in understanding your Medicaid coverage for physical therapy. [https://www.medicaid.gov/]

Medicaid insurance plans are open to home health, hospital outpatient, and rehabilitation clinic services.

👉Where Does Physical Therapy Billings Come in?

At Physical Therapy Billing , we are dedicated to alleviating your burden and ensuring you maximize physical therapy insurance benefits. We provide comprehensive support, irrespective of your insurance provider.

We Understand the Nuances of Your Insurance Coverage.

Our team comprises healthcare billing and insurance specialists with extensive experience in interpreting insurance plans. We conduct a thorough analysis of your specific plan details, including:

- We clarify the financial implications of utilizing in-network versus out-of-network physical therapists.

- We explain the deductible amount you are responsible for paying before your insurance coverage commences.

- We define copay (the fixed fee per visit) and coinsurance (the percentage of covered services you pay after the deductible).

- Our team outlines any limitations on the number of covered physical therapy visits allowed per year or throughout your lifetime under your plan.

By analyzing these details, we can formulate a personalized strategy to optimize your coverage benefits and minimize your out-of-pocket expenses.

Maximizing Reimbursement Through Our Claims Management System

Streamlining Pre-Authorization

Certain treatment plans necessitate pre-authorization from your insurance provider before services are covered. We handle the entire pre-authorization process smoothly , ensuring proper communication and comprehensive documentation are submitted to your insurance company. We work diligently to secure the requisite authorization expeditiously, allowing you to focus on your recovery without delays.

Accurate Coding and Electronic Submission

Our team possesses in-depth knowledge of the ICD, CPT and HCPCS physical therapy billing codes. We correctly code your claims to ensure accuracy and then electronically submit them to your insurance provider for faster processing.

Relentless Advocacy for Fair Reimbursement

Our team reviews your Explanation of Benefits (EOBs) to identify any discrepancies or denials. If necessary, we will advocate on your behalf with your insurance company, ensuring you receive the appropriate reimbursement for covered services.

Find Out All Insurance Provider Plans at Physical Therapy Billings.

Find Out All Insurance Provider Plans at Physical Therapy Billings.

Schedule a call to get an on demand insurance plan for your physical therapy patients billing that gives you full services coverage paid by insurance providers.